Inside Job: A Devastating Look at the 2008 Financial Crisis

Related Articles: Inside Job: A Devastating Look at the 2008 Financial Crisis

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Inside Job: A Devastating Look at the 2008 Financial Crisis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Inside Job: A Devastating Look at the 2008 Financial Crisis

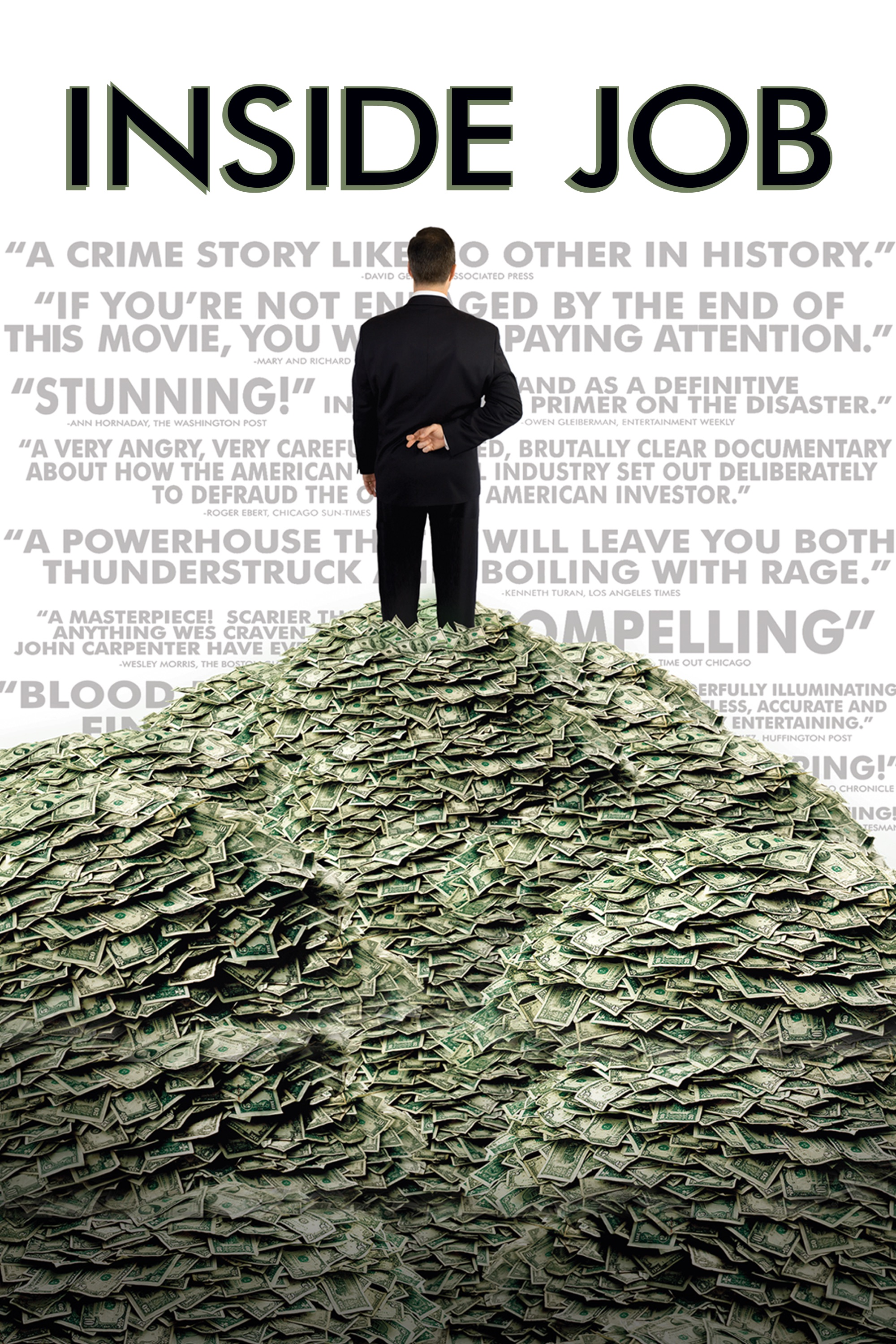

The 2008 financial crisis, a cataclysmic event that shook the global economy, has been the subject of countless analyses and documentaries. Among them, "Inside Job" stands out as a powerful and critically acclaimed film that delves into the intricate web of corruption, deregulation, and greed that led to the collapse. Directed by Charles Ferguson, the documentary won an Academy Award for Best Documentary Feature in 2011, solidifying its position as a landmark work in understanding the financial crisis.

"Inside Job" takes a meticulously researched and unflinching approach, weaving together interviews with economists, financial experts, politicians, and whistleblowers. The film meticulously traces the origins of the crisis back to the 1980s, highlighting the rise of financial deregulation, the proliferation of complex financial instruments, and the growing influence of the financial industry on government policy.

The documentary exposes the revolving door between Wall Street and government, demonstrating how former executives from financial institutions assumed key positions in regulatory agencies, often prioritizing the interests of their former employers over public safety. The film also highlights the role of academic economists who, despite receiving funding from Wall Street, failed to anticipate or adequately warn about the potential risks of the financial system.

"Inside Job" doesn’t shy away from naming names. It directly implicates prominent figures, including former Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke, and former CEO of Goldman Sachs Lloyd Blankfein, exposing their role in the crisis and the subsequent bailout of Wall Street.

The film’s narrative unfolds with a compelling blend of archival footage, animated graphics, and expert interviews, creating a clear and accessible explanation of complex financial concepts. "Inside Job" effectively breaks down the intricate mechanisms of derivatives, subprime mortgages, and other financial instruments, showing how their misuse played a pivotal role in the crisis.

Importance and Benefits of Understanding the Financial Crisis:

"Inside Job" goes beyond simply documenting the financial crisis; it provides crucial insights that are relevant to understanding the contemporary economic landscape. By exposing the systemic flaws that contributed to the crisis, the film serves as a potent reminder of the dangers of unchecked corporate power and the need for robust financial regulations.

The documentary’s impact extends beyond the academic realm. It has sparked public discourse, raised awareness about the financial system, and contributed to the ongoing debate about financial reform. By shedding light on the interconnectedness of the financial industry, government, and academia, "Inside Job" encourages critical thinking about the role of corporations in society and the importance of transparency and accountability.

FAQs:

Q: What were the key factors that contributed to the 2008 financial crisis?

A: The film identifies several key factors, including:

- Deregulation of the financial industry: The loosening of regulations in the 1980s and 1990s allowed financial institutions to engage in increasingly risky practices.

- Subprime mortgages: The widespread issuance of mortgages to borrowers with poor credit history created a bubble in the housing market.

- Complex financial instruments: The use of derivatives and other complex financial instruments masked the true risks of the financial system.

- The revolving door between Wall Street and government: Former financial executives in government positions often prioritized the interests of their former employers over public safety.

- Lack of oversight and transparency: Insufficient regulation and a lack of transparency in the financial industry allowed risky practices to flourish unchecked.

Q: What are the implications of the 2008 financial crisis for the future?

A: The crisis highlighted the interconnectedness of the global financial system and the potential for systemic risk. It also demonstrated the need for stronger regulations, increased transparency, and greater accountability within the financial industry. The crisis also raised concerns about the influence of corporations on government policy and the need for greater public scrutiny of financial institutions.

Q: What actions can be taken to prevent future financial crises?

A: "Inside Job" advocates for several measures, including:

- Stronger financial regulations: Increased oversight and regulation of the financial industry to prevent risky practices.

- Increased transparency: Greater transparency in the financial system to expose potential risks and hold institutions accountable.

- Breaking the revolving door: Limiting the influence of former financial executives in government positions to ensure regulatory independence.

- Reforming the financial industry: Addressing systemic flaws in the financial system, such as the excessive use of complex financial instruments.

- Promoting financial literacy: Educating the public about financial concepts and risks to empower them to make informed decisions.

Tips for Understanding "Inside Job":

- Pay attention to the timeline: The film meticulously traces the events leading up to the crisis, highlighting the key turning points.

- Focus on the interconnectedness: The film emphasizes the interconnectedness of the financial system, highlighting how seemingly isolated events can have far-reaching consequences.

- Consider the ethical implications: "Inside Job" raises important ethical questions about the role of corporations in society and the responsibility of individuals in the financial industry.

- Engage in further research: The film provides a starting point for further research on the financial crisis, its causes, and its consequences.

Conclusion:

"Inside Job" is a powerful and essential documentary that exposes the systemic flaws that led to the 2008 financial crisis. It serves as a stark reminder of the dangers of unchecked corporate power, the need for robust financial regulations, and the importance of transparency and accountability in the financial system. The film’s impact extends beyond simply documenting the crisis; it provides crucial insights that are relevant to understanding the contemporary economic landscape and the challenges facing the global financial system. By shedding light on the interconnectedness of the financial industry, government, and academia, "Inside Job" encourages critical thinking about the role of corporations in society and the importance of ethical behavior in the pursuit of economic prosperity.

Closure

Thus, we hope this article has provided valuable insights into Inside Job: A Devastating Look at the 2008 Financial Crisis. We thank you for taking the time to read this article. See you in our next article!

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/L2UVQSV5IRBM3N5ROI3WKKN2EU)