M-Pesa: A Comprehensive Guide to Mobile Money Transactions in Kenya

Related Articles: M-Pesa: A Comprehensive Guide to Mobile Money Transactions in Kenya

Introduction

With great pleasure, we will explore the intriguing topic related to M-Pesa: A Comprehensive Guide to Mobile Money Transactions in Kenya. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

M-Pesa: A Comprehensive Guide to Mobile Money Transactions in Kenya

M-Pesa, a mobile money service launched in Kenya in 2007, has revolutionized financial inclusion and fostered economic growth across the country. This innovative platform allows users to conduct a wide range of financial transactions using their mobile phones, eliminating the need for traditional banking infrastructure. This article provides a comprehensive guide to using M-Pesa, exploring its functionalities, benefits, and the steps involved in conducting various transactions.

Understanding M-Pesa

M-Pesa, meaning "mobile money" in Swahili, operates on a simple principle: it allows users to store, send, and receive money using their mobile phones. This service is provided by Safaricom, Kenya’s largest mobile network operator, and is accessible to all mobile phone users regardless of their bank account status.

Key Features of M-Pesa

M-Pesa offers a wide range of functionalities, making it a versatile and essential financial tool for individuals and businesses alike. These features include:

- Sending and Receiving Money: Users can transfer funds to other M-Pesa users, bank accounts, or even pay bills directly through the platform.

- Airtime Top-Up: Conveniently recharge mobile phone airtime for oneself or others.

- Bill Payment: Pay for utilities, subscriptions, and other services directly through the M-Pesa platform.

- Lipa na M-Pesa: This feature allows users to make payments at participating merchants using their mobile phones.

- M-Pesa Business: This service provides businesses with tools to manage their finances, receive payments, and track transactions.

- M-Shwari: A micro-savings and loan product that allows users to save small amounts of money and access affordable loans.

- Fuliza: An overdraft facility that allows users to complete transactions even if their M-Pesa balance is insufficient.

Benefits of Using M-Pesa

The widespread adoption of M-Pesa in Kenya is a testament to its numerous benefits, which include:

- Financial Inclusion: M-Pesa has significantly increased financial inclusion, providing access to financial services for individuals who may not have access to traditional banking institutions.

- Convenience and Accessibility: Users can conduct transactions anytime, anywhere with a mobile phone and network connection.

- Security and Reliability: M-Pesa utilizes robust security measures to protect users’ funds and transactions.

- Reduced Costs: Transactions through M-Pesa are often cheaper than traditional banking methods, making it an attractive option for individuals and businesses.

- Economic Growth: M-Pesa has contributed to economic growth by facilitating trade, enabling micro-businesses to thrive, and promoting financial inclusion.

How to Use M-Pesa

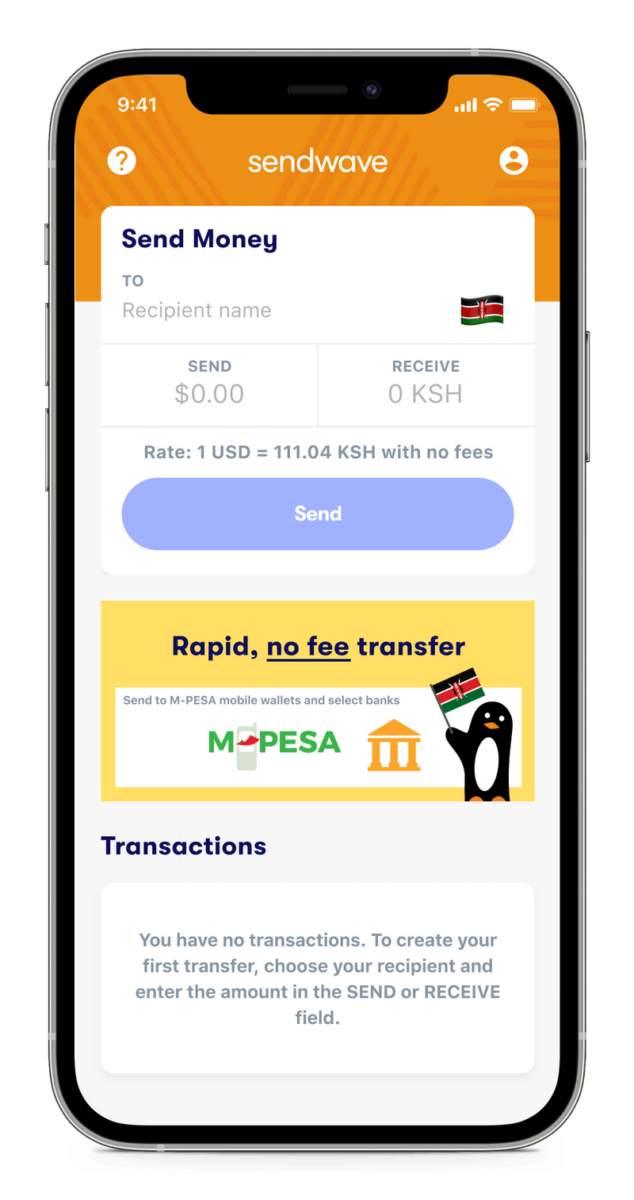

To use M-Pesa, users need to register for an account through their mobile phone. This process typically involves providing personal information and linking a valid mobile phone number. Once registered, users can access the M-Pesa menu through their phone’s USSD code (*110#), mobile app, or online platform.

Conducting Transactions

Here’s a step-by-step guide to performing various M-Pesa transactions:

Sending Money:

- *Dial the USSD code 110#** on your mobile phone.

- Select "Send Money" from the menu.

- Enter the recipient’s M-Pesa number.

- Enter the amount you wish to send.

- Confirm the transaction using your M-Pesa PIN.

Receiving Money:

- You will receive a notification on your phone when someone sends you money through M-Pesa.

- Enter your M-Pesa PIN to confirm the transaction.

Airtime Top-Up:

- *Dial 110#** on your mobile phone.

- Select "Buy Airtime" from the menu.

- Enter the phone number you wish to top up.

- Enter the amount you want to add.

- Confirm the transaction using your M-Pesa PIN.

Bill Payment:

- *Dial 110#** on your mobile phone.

- Select "Pay Bill" from the menu.

- Enter the business’s Pay Bill number.

- Enter the account number or reference number.

- Enter the amount you wish to pay.

- Confirm the transaction using your M-Pesa PIN.

Lipa na M-Pesa:

- Locate a participating merchant displaying the Lipa na M-Pesa logo.

- Inform the cashier about your intention to pay using M-Pesa.

- The cashier will provide you with a Lipa na M-Pesa code.

- *Dial 110#** on your mobile phone.

- Select "Lipa na M-Pesa" from the menu.

- Enter the Lipa na M-Pesa code provided by the cashier.

- Enter the amount you wish to pay.

- Confirm the transaction using your M-Pesa PIN.

M-Pesa Business:

- Register for an M-Pesa Business account through the Safaricom website or by visiting a Safaricom shop.

- You will receive a unique business number and access to various tools for managing your finances, receiving payments, and tracking transactions.

M-Shwari:

- *Dial 234#** on your mobile phone.

- Follow the prompts to register for an M-Shwari account.

- You can then save money, access loans, and manage your account through the platform.

Fuliza:

- Fuliza is automatically enabled for eligible M-Pesa users.

- When you have insufficient funds in your M-Pesa account, Fuliza will provide an overdraft facility to complete your transaction.

- You will be charged interest on the overdraft amount.

FAQs

Q: How do I register for an M-Pesa account?

A: To register for an M-Pesa account, you need to visit a Safaricom shop or an authorized M-Pesa agent. You will need to provide your personal information, including your name, ID number, and mobile phone number.

Q: What is the maximum amount of money I can send or receive through M-Pesa?

A: The maximum amount of money you can send or receive through M-Pesa varies depending on your account status and transaction limits set by Safaricom.

Q: Is M-Pesa safe?

A: M-Pesa utilizes robust security measures to protect users’ funds and transactions. These measures include encryption, PIN verification, and fraud monitoring systems.

Q: What happens if I forget my M-Pesa PIN?

A: If you forget your M-Pesa PIN, you can reset it by visiting a Safaricom shop or an authorized M-Pesa agent. You will need to provide proof of identity to reset your PIN.

Q: Can I use M-Pesa outside of Kenya?

A: While M-Pesa is primarily used in Kenya, some international partners offer similar mobile money services that allow users to send and receive money internationally.

Tips for Using M-Pesa

- Keep your M-Pesa PIN confidential.

- Be wary of scams and phishing attempts.

- Check your transaction history regularly.

- Report any suspicious activity to Safaricom immediately.

- Utilize the M-Pesa mobile app for added convenience and functionality.

Conclusion

M-Pesa has transformed the financial landscape in Kenya, offering a convenient, secure, and affordable way for individuals and businesses to manage their finances. Its wide range of functionalities, coupled with its accessibility and benefits, have made it an essential tool for promoting financial inclusion and economic growth. As M-Pesa continues to evolve and expand its services, it is poised to play an even greater role in shaping the future of financial technology in Kenya and beyond.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21870680/GettyImages_74504527.jpg)

Closure

Thus, we hope this article has provided valuable insights into M-Pesa: A Comprehensive Guide to Mobile Money Transactions in Kenya. We appreciate your attention to our article. See you in our next article!