Navigating the Digital Landscape: A Comprehensive Guide to M-Pesa Online

Related Articles: Navigating the Digital Landscape: A Comprehensive Guide to M-Pesa Online

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Digital Landscape: A Comprehensive Guide to M-Pesa Online. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: A Comprehensive Guide to M-Pesa Online

M-Pesa, a mobile money service pioneered by Safaricom in Kenya, has revolutionized financial transactions across Africa and beyond. Its online platform, accessible through a web browser or mobile app, extends its reach, offering a seamless and convenient way to manage finances, pay bills, and transfer funds. This comprehensive guide delves into the intricacies of using M-Pesa online, equipping users with the knowledge and skills to navigate this digital landscape effectively.

Understanding the M-Pesa Online Ecosystem

The M-Pesa online platform serves as a virtual extension of the traditional mobile money service. It provides a secure and user-friendly interface to perform various financial transactions, including:

- Sending and receiving money: Transfer funds to other M-Pesa users, bank accounts, and even international recipients, all from the comfort of a computer or mobile device.

- Paying bills: Settle utility bills, school fees, and other recurring expenses directly through the platform, eliminating the need for physical visits or queues.

- Purchasing goods and services: Make online payments for various products and services, ranging from online shopping to airtime top-up, using the secure M-Pesa platform.

- Accessing financial services: Manage your M-Pesa account, view transaction history, and access other financial services like micro-loans and savings products.

Getting Started: A Step-by-Step Guide

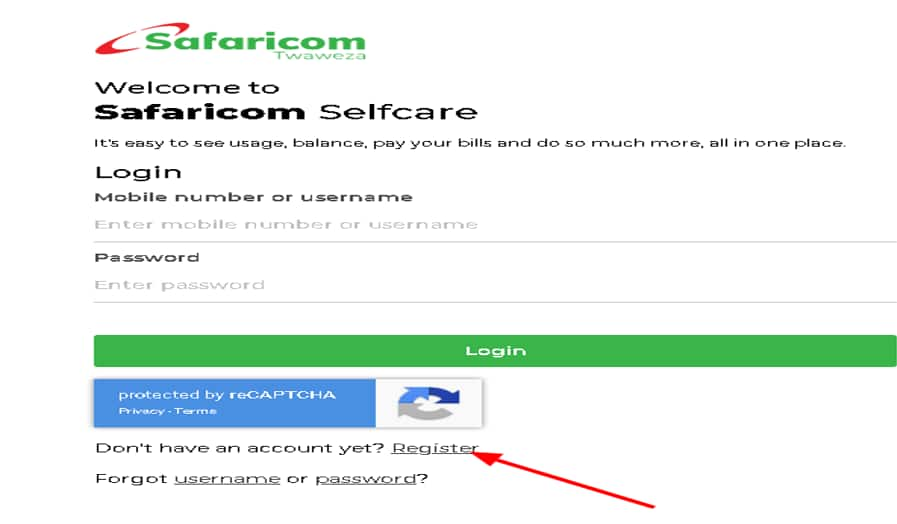

- Registration: To access the M-Pesa online platform, users must first register their mobile number with Safaricom. This process typically involves providing personal details and a valid ID document.

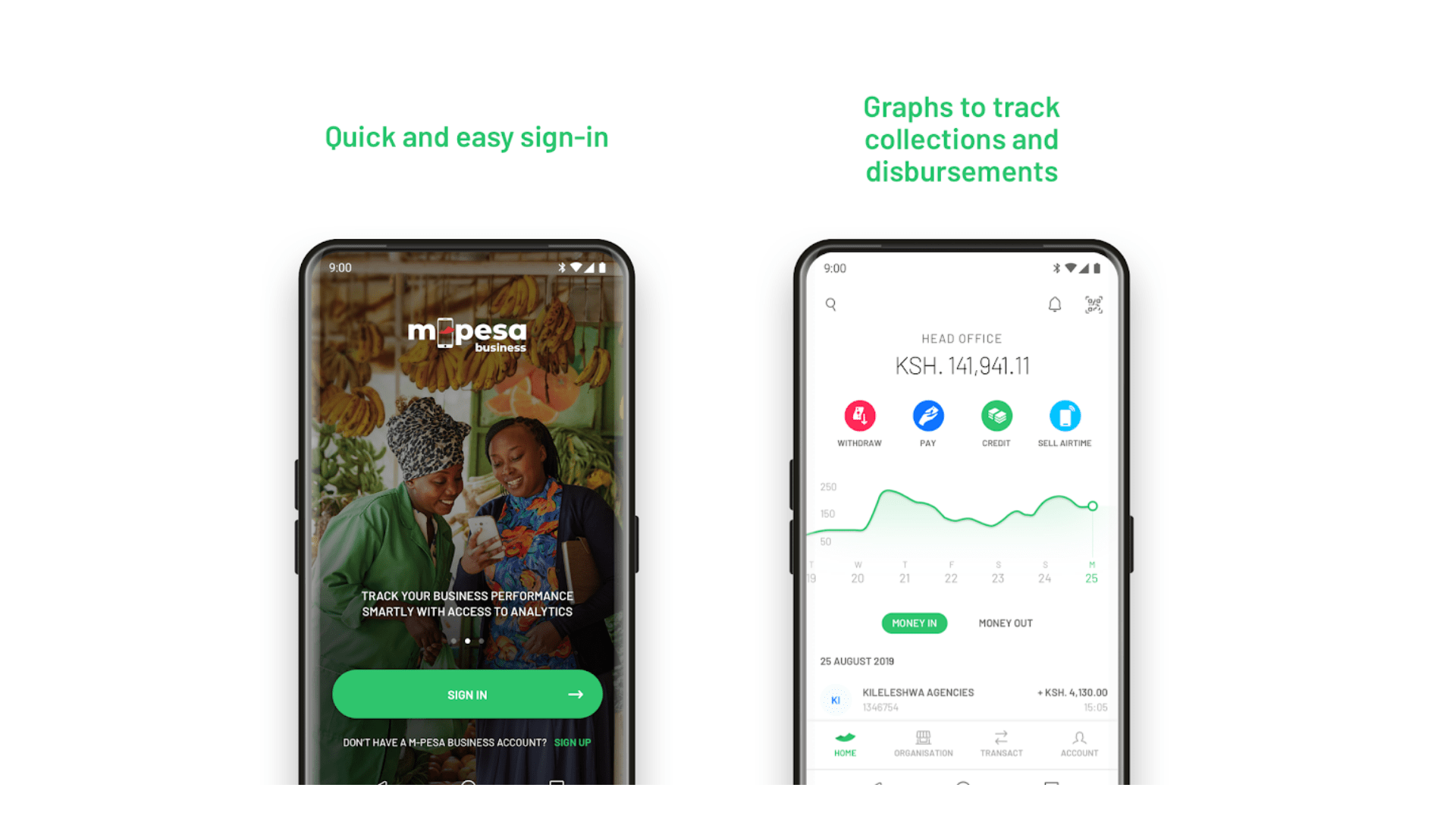

- Login: Once registered, users can access the M-Pesa online platform by logging in using their mobile number and PIN. The platform offers both web and mobile app versions, providing flexibility for different user preferences.

- Navigating the Interface: The M-Pesa online platform features a user-friendly interface with clear navigation menus and intuitive functionalities. Users can easily locate desired services and perform transactions with minimal effort.

- Security Measures: M-Pesa prioritizes security with robust measures such as two-factor authentication, secure login procedures, and encrypted data transmission, ensuring the safety of user funds and personal information.

Key Features and Functionalities

1. Send Money:

- Domestic Transfers: Transfer funds to other M-Pesa users within Kenya using their mobile number or M-Pesa account number.

- International Transfers: Send money to international recipients through various partners, offering a convenient way to connect with loved ones abroad.

- Bank Transfers: Transfer funds to bank accounts within Kenya, streamlining financial transactions between different platforms.

2. Pay Bills:

- Utility Bills: Pay electricity, water, and gas bills directly through the platform, eliminating the need for physical visits or queues.

- School Fees: Settle school fees conveniently, saving time and effort compared to traditional payment methods.

- Other Recurring Expenses: Pay for insurance premiums, subscriptions, and other recurring expenses with ease, ensuring timely payments.

3. Purchase Goods and Services:

- Online Shopping: Make secure online payments for a wide range of products and services, enjoying the convenience of online shopping.

- Airtime Top-up: Top up your mobile airtime directly through the platform, ensuring uninterrupted communication.

- Other Services: Pay for various services like transport, entertainment, and food delivery using the secure M-Pesa platform.

4. Access Financial Services:

- Account Management: View transaction history, manage your M-Pesa balance, and access other account-related information.

- Micro-loans: Apply for and manage micro-loans, providing access to financial resources for various needs.

- Savings Products: Access and manage savings products, allowing users to save money and grow their finances.

Benefits of Using M-Pesa Online

- Convenience: Perform financial transactions from anywhere with an internet connection, eliminating the need for physical visits or queues.

- Security: Robust security measures ensure the safety of user funds and personal information, providing peace of mind during transactions.

- Accessibility: The platform is accessible to a wide range of users, including those without traditional bank accounts, promoting financial inclusion.

- Cost-Effectiveness: Compared to traditional banking services, M-Pesa online offers competitive fees and charges, making financial transactions more affordable.

- Flexibility: The platform offers a wide range of services, catering to diverse financial needs and enabling users to manage their finances effectively.

FAQs: Addressing Common Concerns

1. Is it safe to use M-Pesa online?

M-Pesa prioritizes security with robust measures such as two-factor authentication, secure login procedures, and encrypted data transmission. These measures protect user funds and personal information, ensuring safe and secure transactions.

2. How do I register for M-Pesa online?

To register for M-Pesa online, users must first register their mobile number with Safaricom. This process typically involves providing personal details and a valid ID document.

3. What are the transaction fees for using M-Pesa online?

Transaction fees for using M-Pesa online vary depending on the type of transaction and the recipient. Detailed information on fees is readily available on the M-Pesa website and mobile app.

4. Can I use M-Pesa online to send money internationally?

Yes, M-Pesa online allows users to send money to international recipients through various partners, offering a convenient way to connect with loved ones abroad.

5. How can I access customer support for M-Pesa online?

M-Pesa provides comprehensive customer support through various channels, including a dedicated hotline, email address, and online chat service.

Tips for Effective M-Pesa Online Usage

- Keep your PIN confidential: Never share your PIN with anyone, even family members or friends.

- Use strong passwords: Choose strong and unique passwords for your M-Pesa online account.

- Enable two-factor authentication: This additional security layer adds an extra layer of protection to your account.

- Monitor your transaction history: Regularly review your transaction history to ensure accuracy and identify any suspicious activity.

- Report any security breaches immediately: If you suspect any security breaches, contact M-Pesa customer support immediately.

Conclusion

M-Pesa online has emerged as a transformative force in the financial landscape, offering convenience, security, and accessibility to a wide range of users. By understanding the platform’s features, functionalities, and benefits, users can leverage its power to manage their finances effectively and navigate the digital world with confidence. As technology continues to evolve, M-Pesa online will undoubtedly continue to play a crucial role in shaping the future of financial transactions, offering a seamless and user-friendly experience for individuals and businesses alike.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: A Comprehensive Guide to M-Pesa Online. We appreciate your attention to our article. See you in our next article!