Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with GCash

Related Articles: Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with GCash

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with GCash. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with GCash

In the contemporary digital age, financial transactions have undergone a significant transformation. The advent of mobile wallets has revolutionized the way individuals and businesses conduct financial operations, fostering a seamless and secure online payment ecosystem. Among these digital payment platforms, GCash stands out as a prominent and widely utilized mobile wallet in the Philippines, empowering users with a multitude of convenient and secure payment options.

This comprehensive guide delves into the intricacies of utilizing GCash for online payments, providing a detailed understanding of its functionalities, benefits, and security measures. By meticulously outlining the process, this guide aims to equip users with the necessary knowledge to confidently navigate the online payment landscape with GCash.

Understanding GCash: A Gateway to Digital Transactions

GCash, a mobile wallet service developed by Mynt, a subsidiary of Globe Telecom, has emerged as a cornerstone of digital financial services in the Philippines. It enables users to perform a wide array of financial transactions, including:

- Sending and Receiving Money: GCash facilitates swift and secure money transfers between users, eliminating the need for physical cash transactions.

- Paying Bills: Users can conveniently settle various bills, such as utilities, internet, and cable subscriptions, through their GCash accounts.

- Shopping Online: GCash seamlessly integrates with online stores and marketplaces, enabling users to make purchases using their mobile wallets.

- Loading Prepaid Credits: GCash allows users to top up their mobile phone credits, as well as other prepaid services.

- Cashing Out: Users can withdraw funds from their GCash accounts at designated partner outlets.

Embarking on the Journey: A Step-by-Step Guide to Online Payments with GCash

- Registering for GCash: To begin using GCash, users need to register for an account. This process typically involves providing personal information, such as name, mobile number, and email address, and verifying identity through a valid government-issued ID.

- Funding the GCash Account: Once registered, users can fund their GCash accounts through various methods, including bank transfers, cash deposits at partner outlets, and debit/credit card payments.

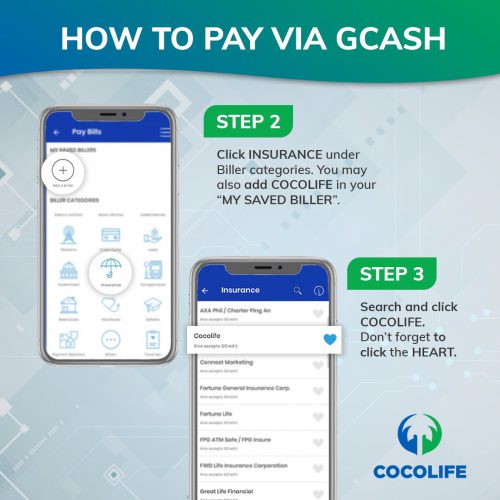

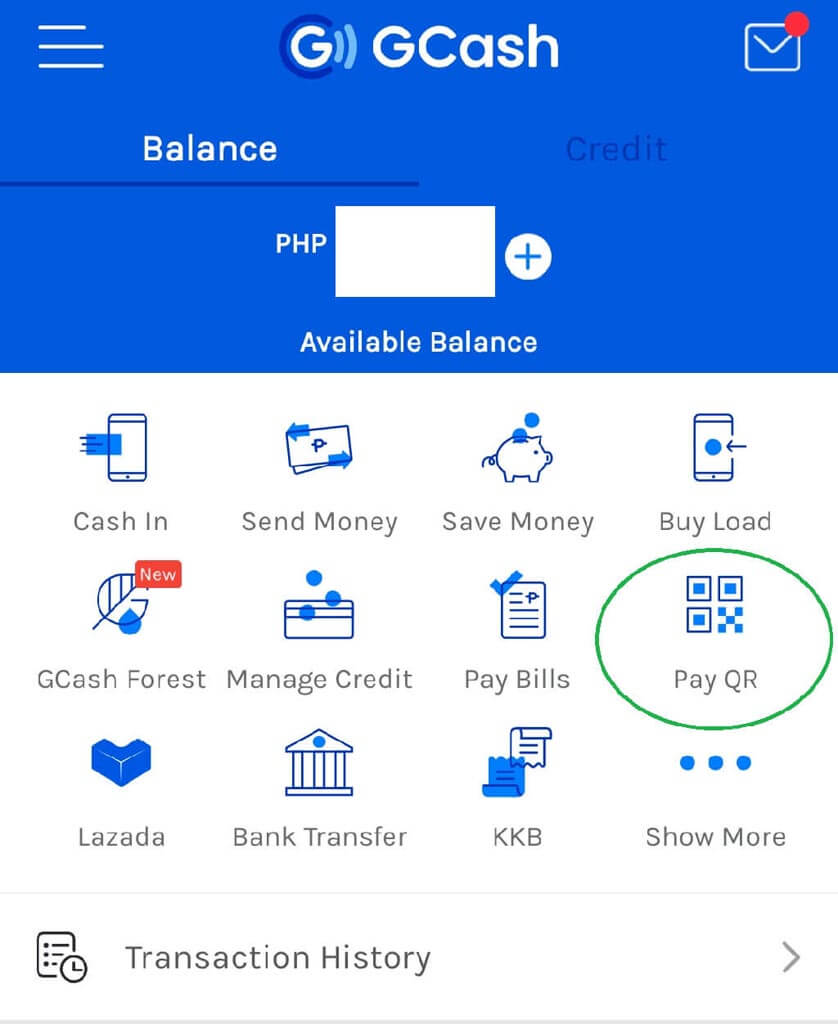

- Initiating an Online Payment: When making an online payment, users can select GCash as their preferred payment method at checkout. The merchant will then redirect the user to the GCash app for authentication and confirmation.

- Authentication and Confirmation: Users are required to authenticate the transaction using their GCash PIN or biometric authentication methods, such as fingerprint or facial recognition.

- Payment Completion: Upon successful authentication, the payment is processed and confirmed, and the user receives a notification confirming the transaction.

Benefits of Online Payments with GCash: A Paradigm Shift in Financial Convenience

Utilizing GCash for online payments offers a myriad of benefits, revolutionizing the way individuals manage their finances:

- Convenience and Accessibility: GCash eliminates the need for physical cash and provides convenient access to financial services through a mobile app, accessible anytime and anywhere.

- Security and Safety: GCash employs robust security measures, including PIN authentication, biometric verification, and encryption, to protect user accounts and transactions from unauthorized access.

- Faster Transactions: Compared to traditional payment methods, GCash transactions are typically processed faster, providing a seamless and efficient payment experience.

- Reduced Fees: GCash often offers competitive transaction fees compared to other payment methods, making it a cost-effective option for online payments.

- Wide Acceptance: GCash is widely accepted by a growing number of online merchants and service providers, expanding its utility and convenience for users.

Navigating the Unfamiliar: Addressing Frequently Asked Questions

Q1: Is it safe to use GCash for online payments?

A1: GCash prioritizes security and employs robust measures to protect user accounts and transactions. These measures include PIN authentication, biometric verification, and encryption, ensuring a secure online payment experience.

Q2: How do I add funds to my GCash account?

A2: Users can fund their GCash accounts through various methods, including bank transfers, cash deposits at partner outlets, and debit/credit card payments.

Q3: What are the transaction fees for using GCash for online payments?

A3: Transaction fees may vary depending on the merchant and the amount of the transaction. Users can check the GCash app or website for specific fee details.

Q4: Can I use GCash to pay for international transactions?

A4: While GCash primarily focuses on domestic transactions, it may offer limited international payment options through partnerships with other payment providers.

Q5: What should I do if I encounter a problem with a GCash transaction?

A5: Users can contact GCash customer support for assistance with any issues or concerns related to transactions.

Tips for Enhancing the GCash Online Payment Experience

- Enable Biometric Authentication: Utilize fingerprint or facial recognition for added security and convenience during transaction authentication.

- Keep GCash App Updated: Regularly update the GCash app to benefit from the latest security features and improvements.

- Review Transaction History: Regularly check your transaction history for any suspicious activity and report any discrepancies to GCash customer support.

- Use a Strong PIN: Choose a strong and unique PIN for your GCash account to enhance security.

- Be Aware of Phishing Scams: Be vigilant against phishing attempts and never share your GCash PIN or other sensitive information with unauthorized individuals or websites.

Conclusion: Embracing the Future of Online Payments with GCash

GCash has emerged as a transformative force in the Philippine digital payment landscape, providing a secure, convenient, and accessible platform for online transactions. By leveraging its robust features and functionalities, users can confidently navigate the online payment ecosystem, embracing the future of financial transactions. As GCash continues to evolve and expand its reach, it promises to further revolutionize the way individuals and businesses conduct financial operations, fostering a more efficient, secure, and inclusive digital economy.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with GCash. We thank you for taking the time to read this article. See you in our next article!