Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with M-Pesa

Related Articles: Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with M-Pesa

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with M-Pesa. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with M-Pesa

M-Pesa, a mobile money service widely adopted across Africa, has revolutionized financial transactions, enabling individuals and businesses to conduct financial operations conveniently and securely through their mobile devices. The service extends beyond simple person-to-person transfers, facilitating online payments for a multitude of goods and services. This article provides a comprehensive guide to navigating the world of online payments with M-Pesa, highlighting its significance and offering practical insights for users.

Understanding M-Pesa’s Role in Online Transactions

M-Pesa’s integration into the digital landscape has transformed the way individuals and businesses interact financially. It empowers users to:

- Pay for goods and services online: From purchasing airline tickets and booking hotel rooms to acquiring digital products and subscribing to online services, M-Pesa facilitates seamless online payments.

- Make secure online transactions: M-Pesa utilizes robust security protocols, ensuring the safety of sensitive financial information during online transactions.

- Access financial services remotely: Users can manage their finances, pay bills, and transfer funds conveniently through their mobile devices, eliminating the need for physical bank visits.

- Conduct business transactions efficiently: M-Pesa streamlines business operations by enabling businesses to receive payments from customers, pay suppliers, and manage their finances digitally.

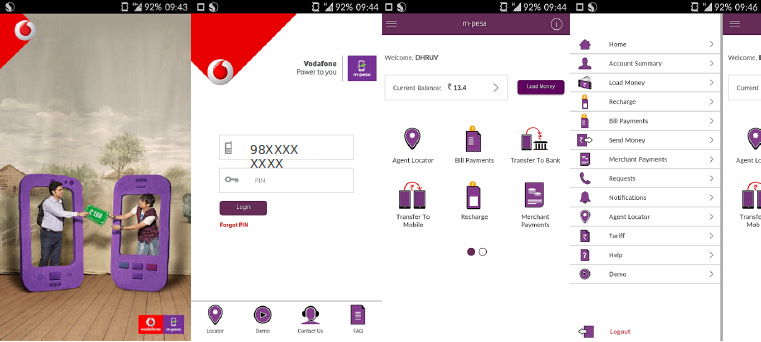

Methods of Online Payment with M-Pesa

Several methods enable users to make online payments using M-Pesa:

- M-Pesa Paybill: This method allows users to make payments to businesses and organizations registered with M-Pesa. The process involves selecting the Paybill option on the M-Pesa menu, entering the Paybill number, account number, and amount.

- M-Pesa Lipa na M-Pesa: This method facilitates online payments through a secure platform. Users can select the Lipa na M-Pesa option on the merchant’s website or app, enter their M-Pesa number, and confirm the transaction using their PIN.

- M-Pesa Online: This method enables users to make online payments directly from their M-Pesa account. It requires users to register for an M-Pesa Online account and link it to their M-Pesa wallet.

Navigating the Payment Process

Making online payments with M-Pesa is a straightforward process, requiring a few steps:

- Choose the payment method: Select the appropriate M-Pesa payment method based on the merchant’s preferred option.

- Enter the required information: Provide the necessary details, including the Paybill number, account number, amount, and your M-Pesa PIN.

- Confirm the transaction: Review the payment details and confirm the transaction.

- Receive confirmation: Once the transaction is successful, you will receive a confirmation message on your mobile device.

Security Measures for Online Payments

M-Pesa prioritizes security and employs several measures to protect user information and transactions:

- PIN verification: Every transaction requires a unique PIN, ensuring only the authorized user can access the account.

- Secure platform: M-Pesa utilizes secure platforms for online payments, encrypting sensitive information to prevent unauthorized access.

- Fraud detection systems: Robust systems monitor transactions for suspicious activity, alerting users and preventing fraudulent attempts.

Benefits of Online Payments with M-Pesa

The adoption of M-Pesa for online payments offers numerous benefits:

- Convenience: Users can make payments anytime, anywhere, using their mobile devices.

- Accessibility: M-Pesa’s widespread availability makes it accessible to a broad population, even those without traditional bank accounts.

- Security: M-Pesa’s robust security measures ensure the safety of user information and transactions.

- Cost-effectiveness: Compared to traditional payment methods, M-Pesa offers lower transaction fees, making it a more cost-effective option.

Frequently Asked Questions (FAQs)

Q: How can I register for M-Pesa Online?

A: To register for M-Pesa Online, follow these steps:

- Visit the M-Pesa website or app.

- Select the "M-Pesa Online" option.

- Enter your M-Pesa number and follow the instructions to create an account.

Q: How can I link my M-Pesa wallet to my M-Pesa Online account?

A: To link your M-Pesa wallet to your M-Pesa Online account, follow these steps:

- Log in to your M-Pesa Online account.

- Navigate to the "Wallet" section.

- Enter your M-Pesa number and follow the instructions to link your wallet.

Q: How do I make a payment using M-Pesa Paybill?

A: To make a payment using M-Pesa Paybill, follow these steps:

- Open your M-Pesa menu.

- Select "Lipa na M-Pesa".

- Choose "Paybill".

- Enter the Paybill number, account number, and amount.

- Confirm the transaction using your PIN.

Q: What are the transaction fees for online payments with M-Pesa?

A: Transaction fees for online payments with M-Pesa vary depending on the payment method and merchant. You can find detailed information on the M-Pesa website or app.

Q: How can I check my transaction history for online payments made with M-Pesa?

A: To check your transaction history for online payments made with M-Pesa, follow these steps:

- Open your M-Pesa menu.

- Select "M-Pesa Statement".

- Choose the desired timeframe and view your transaction history.

Tips for Using M-Pesa for Online Payments

- Ensure a stable internet connection: A strong internet connection is crucial for smooth online transactions.

- Verify the merchant’s authenticity: Ensure the website or app you are using is legitimate and secure.

- Keep your M-Pesa PIN confidential: Do not share your PIN with anyone and avoid saving it on your device.

- Monitor your account activity: Regularly review your transaction history to detect any suspicious activity.

- Contact M-Pesa customer support if you encounter any issues: Reach out to M-Pesa customer support for assistance with any problems or queries.

Conclusion

M-Pesa’s role in facilitating online payments has significantly contributed to the growth of the digital economy, empowering individuals and businesses to engage in seamless and secure financial transactions. By understanding the various methods of online payment with M-Pesa, users can leverage this innovative service to streamline their financial activities and enjoy the numerous benefits it offers. As technology continues to evolve, M-Pesa will undoubtedly play an increasingly vital role in shaping the future of digital payments.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: A Comprehensive Guide to Online Payments with M-Pesa. We hope you find this article informative and beneficial. See you in our next article!