Navigating the Digital Landscape: A Comprehensive Guide to Online PF Withdrawal

Related Articles: Navigating the Digital Landscape: A Comprehensive Guide to Online PF Withdrawal

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Digital Landscape: A Comprehensive Guide to Online PF Withdrawal. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Digital Landscape: A Comprehensive Guide to Online PF Withdrawal

The Employees’ Provident Fund (EPF) is a cornerstone of financial security for working individuals in India. It serves as a retirement savings scheme, providing a safety net for the future. However, there are instances when an individual may need to access these funds before retirement, such as purchasing a home, covering medical expenses, or starting a new venture. The digital age has brought about a significant shift in the way these withdrawals are processed, offering a convenient and efficient online platform. This guide aims to provide a comprehensive understanding of the process, addressing key steps and considerations, and offering insights into the benefits of online PF withdrawal.

Understanding the Process: A Step-by-Step Guide

The online withdrawal process is facilitated by the Employees’ Provident Fund Organisation (EPFO) through its official website. The process typically involves the following steps:

-

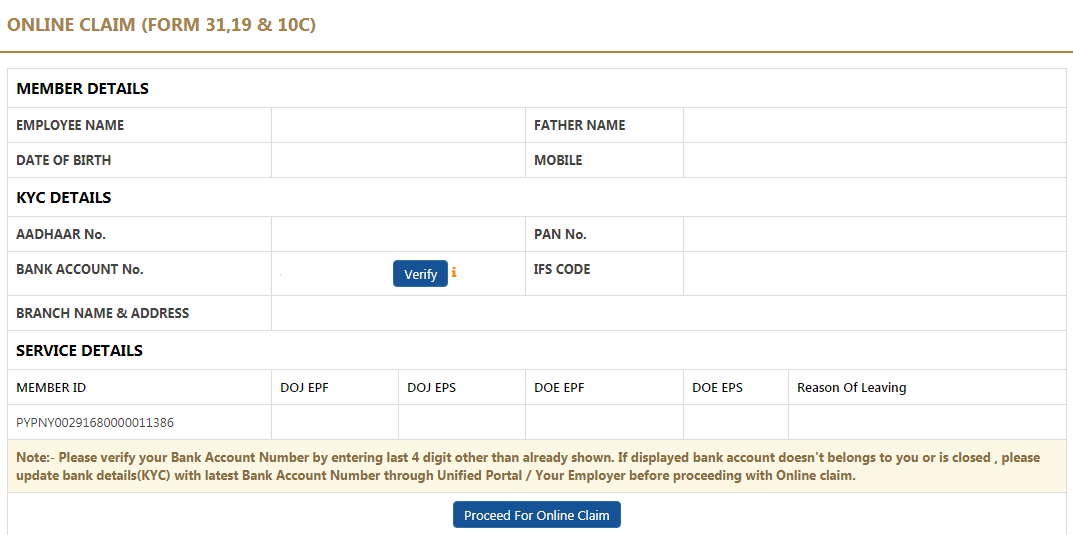

Member Registration: If you haven’t already registered on the EPFO website, you need to create an account using your Universal Account Number (UAN), which is a unique identifier for each EPF member.

-

UAN Activation: Once registered, you must activate your UAN by linking it to your Aadhaar number, a crucial step for online transactions.

-

Login and Access: Using your registered UAN and password, log in to the EPFO website and navigate to the "Online Services" section.

-

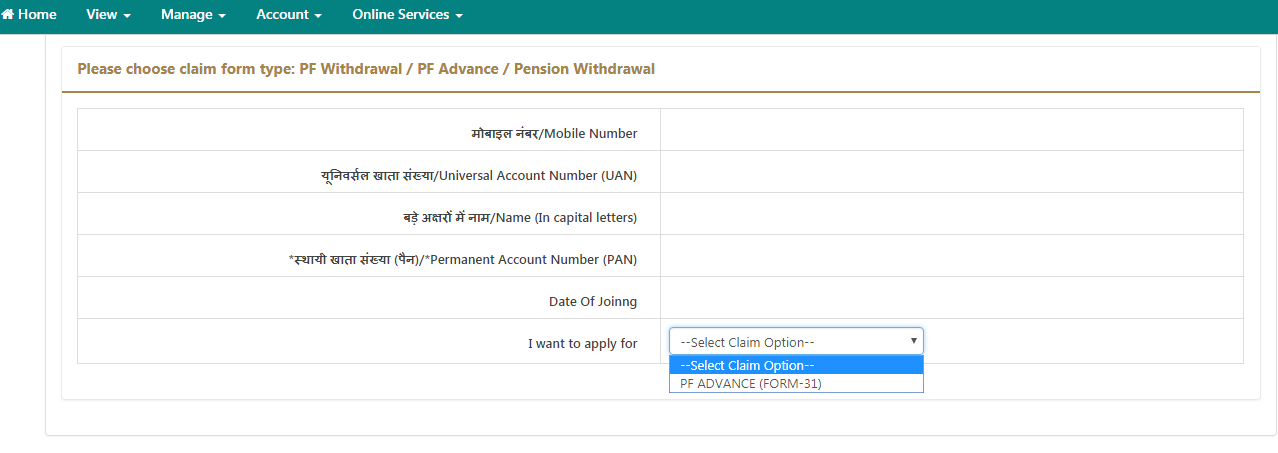

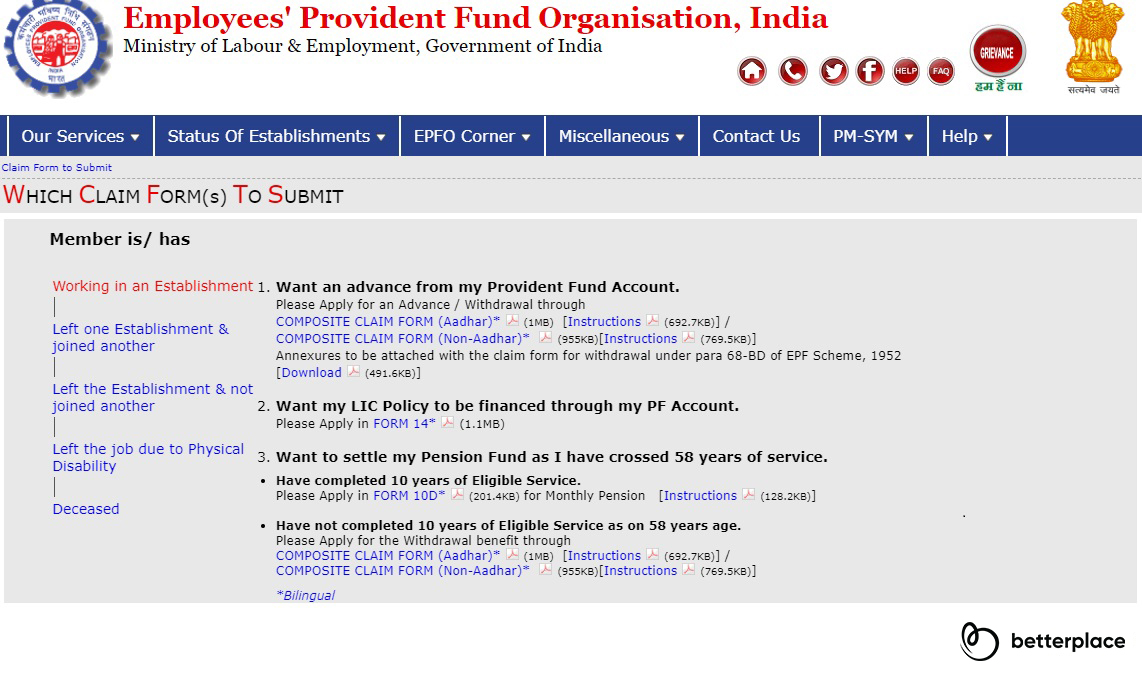

Select Withdrawal Form: The EPFO website provides various forms for different withdrawal scenarios. Choose the form that aligns with your specific reason for withdrawal, such as partial withdrawal, full withdrawal, or withdrawal for specific purposes like marriage, education, or house construction.

-

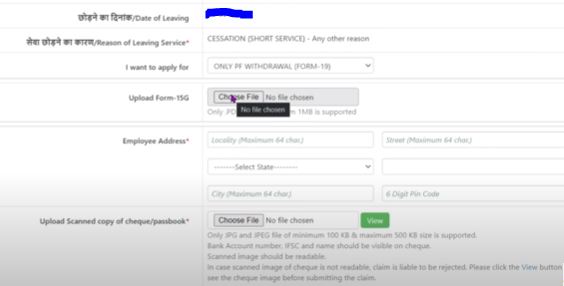

Fill Out Form: Carefully fill out the chosen form with accurate information, including your bank account details, reason for withdrawal, and supporting documents.

-

Digital Signature: The form requires a digital signature, which can be obtained through the e-KYC process, where your Aadhaar details are verified electronically.

-

Submit and Track: Once completed, submit the form electronically. You can track the status of your withdrawal request online through the EPFO website.

Benefits of Online PF Withdrawal:

-

Convenience: The online platform eliminates the need for physical visits to EPFO offices, saving time and effort.

-

Efficiency: The process is streamlined, reducing the processing time compared to traditional methods.

-

Transparency: The online platform provides real-time tracking of your withdrawal request, offering transparency throughout the process.

-

Security: The EPFO website employs robust security measures, ensuring the safety of your personal and financial information.

Considerations and FAQs

1. Eligibility: The eligibility criteria for PF withdrawal vary depending on the withdrawal type. For instance, full withdrawal is typically allowed after retirement or if you have resigned from your job and haven’t joined a new one within six months.

2. Documents Required: The specific documents required for withdrawal depend on the chosen form. Generally, these may include:

* **Proof of identity:** Aadhaar card, PAN card, passport, or driving license.

* **Proof of address:** Aadhaar card, voter ID card, or utility bill.

* **Bank account details:** Bank passbook or statement.

* **Supporting documents:** Relevant documents based on the reason for withdrawal, such as marriage certificate, education certificates, or property documents.3. Processing Time: The processing time for online PF withdrawal can vary depending on the workload and the completeness of the submitted documents. However, it is generally faster than traditional methods.

4. Withdrawal Restrictions: There may be limitations on the amount that can be withdrawn for specific purposes. It is essential to refer to the EPFO website or consult with an EPFO representative for detailed information.

5. Tax Implications: Withdrawals from your EPF account may be subject to income tax based on the applicable tax slab and withdrawal type. It is advisable to consult with a tax advisor for specific guidance.

6. What if I have multiple UANs? If you have multiple UANs due to working with different employers, you need to withdraw funds from each UAN separately using the same process outlined above.

7. What if I have lost my UAN? You can retrieve your UAN by contacting the EPFO through their website or helpline. You will need to provide your basic details and proof of identity.

8. Can I withdraw PF online if I am still employed? Yes, you can withdraw a portion of your PF balance for specific purposes, such as marriage, education, or house construction, even if you are still employed.

9. What if my withdrawal request is rejected? If your request is rejected, you will receive a notification outlining the reason for rejection. You can then resubmit your request after addressing the issues raised.

10. What if I have forgotten my password? You can reset your password by following the password reset instructions available on the EPFO website.

Tips for a Smooth Online Withdrawal Experience:

-

Keep your UAN and password secure: Do not share these details with anyone.

-

Ensure accurate information: Double-check the information provided in the withdrawal form to avoid delays.

-

Scan and upload documents: Ensure clear and legible scans of all required documents.

-

Keep track of your withdrawal request: Monitor the status of your request through the EPFO website.

-

Contact EPFO for assistance: If you face any difficulties or have any queries, contact the EPFO through their website or helpline.

Conclusion:

The online PF withdrawal process offers a convenient and efficient way to access your hard-earned savings. By understanding the steps, considerations, and benefits, you can navigate the digital landscape effectively and ensure a smooth withdrawal experience. It is crucial to remember that the EPFO website is the official platform for all online transactions. By adhering to the guidelines provided and seeking assistance when necessary, you can access your PF funds with confidence and ease.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Digital Landscape: A Comprehensive Guide to Online PF Withdrawal. We hope you find this article informative and beneficial. See you in our next article!