Navigating the Online PF Withdrawal Process After Resignation: A Comprehensive Guide

Related Articles: Navigating the Online PF Withdrawal Process After Resignation: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Online PF Withdrawal Process After Resignation: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Online PF Withdrawal Process After Resignation: A Comprehensive Guide

The Employees’ Provident Fund (EPF) serves as a vital financial safety net for employees in India. It provides a secure platform for savings and offers a lump-sum withdrawal upon resignation or retirement. In today’s digital age, the process of withdrawing your EPF funds after resignation has become significantly streamlined through online platforms. This comprehensive guide aims to provide a clear and detailed understanding of the online withdrawal procedure, equipping individuals with the necessary knowledge to navigate the process effectively.

Understanding the EPF Withdrawal Process

The EPF withdrawal process after resignation is governed by specific guidelines outlined by the Employees’ Provident Fund Organization (EPFO). The process generally involves the following steps:

-

Submitting a Withdrawal Form: The first step involves submitting a Form 19, also known as the "Claim Form for Withdrawal of Provident Fund," to the EPFO. This form requires the individual’s personal details, employment information, and the desired withdrawal amount.

-

Verification and Processing: Upon receiving the Form 19, the EPFO initiates a verification process to ensure the validity of the application. This involves cross-checking the information provided with the employee’s records and obtaining necessary approvals from the employer.

-

Disbursement of Funds: Once the application is verified and approved, the EPFO proceeds with the disbursement of the funds to the individual’s bank account. The time taken for processing and disbursing the funds can vary depending on the efficiency of the EPFO and the complexity of the application.

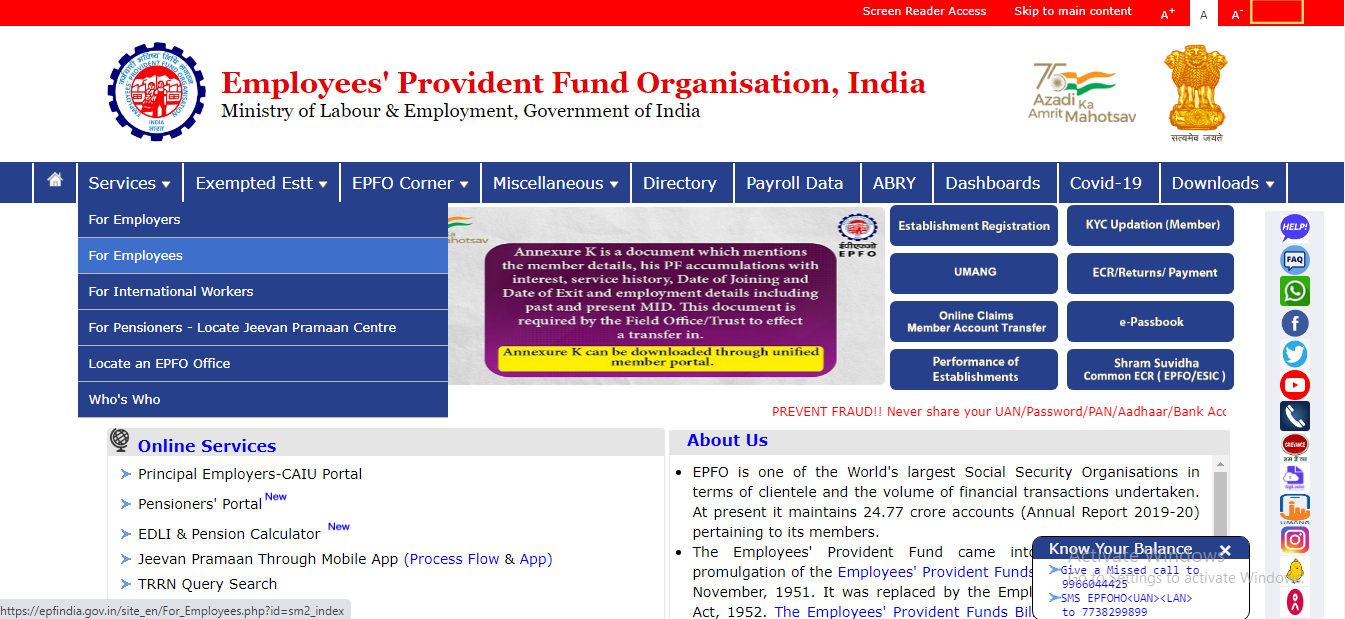

Accessing the Online PF Withdrawal Portal

The EPFO has established an online portal known as the Unified Portal for EPF (Unified Portal) that facilitates the withdrawal process. This portal provides a user-friendly interface for submitting withdrawal applications, tracking their progress, and accessing relevant information. To access the Unified Portal, individuals need to have their Universal Account Number (UAN) and password.

Step-by-Step Guide to Online PF Withdrawal

-

Login to the Unified Portal: Navigate to the EPFO’s Unified Portal website and log in using your UAN and password.

-

Access the Online Services: Once logged in, locate the "Online Services" section and select "Claim (Form 31, 19 & 10C)".

-

Select the Withdrawal Form: Choose "Form 19" from the list of available forms to initiate the PF withdrawal process.

-

Fill in the Application Form: Carefully fill in all the required details in the Form 19. This includes your personal information, employment details, bank account information, and the desired withdrawal amount.

-

Upload Supporting Documents: The online portal may require you to upload supporting documents such as your resignation letter, bank statement, and KYC documents. Ensure that the uploaded documents are clear and legible.

-

Submit the Application: After completing all the necessary steps, review the application form carefully and submit it electronically.

-

Track the Application Status: You can track the status of your application online by logging into the Unified Portal and accessing the "Claim Status" section.

Important Considerations for Online PF Withdrawal

-

UAN Activation: Ensure your UAN is active and linked to your Aadhaar number. This is crucial for accessing the online portal and submitting the withdrawal application.

-

Bank Account Details: Provide accurate and up-to-date bank account details in the application form. Any discrepancy in the bank account information may delay the disbursement of funds.

-

Employer’s Approval: The employer needs to approve your withdrawal application. Contact your employer and ensure they are aware of your intention to withdraw PF funds.

-

Withdrawal Rules: Familiarize yourself with the EPFO’s withdrawal rules and regulations. These rules dictate the eligible withdrawal amounts and the circumstances under which withdrawals can be made.

Benefits of Online PF Withdrawal

-

Convenience and Efficiency: Online PF withdrawal eliminates the need for physical visits to EPFO offices, saving time and effort.

-

Transparency and Real-time Tracking: The online portal provides transparency throughout the withdrawal process, allowing individuals to track the progress of their application in real-time.

-

Reduced Processing Time: Online applications are processed faster compared to traditional methods, reducing the time taken for disbursing the funds.

FAQs on Online PF Withdrawal

1. What is the minimum amount I can withdraw from my PF account after resignation?

The minimum amount you can withdraw from your PF account after resignation is typically INR 1,000. However, this amount may vary depending on the EPFO’s regulations and the specific circumstances of your withdrawal.

2. Can I withdraw my entire PF balance after resignation?

Yes, you can withdraw your entire PF balance after resignation, subject to the EPFO’s withdrawal rules and regulations.

3. How long does it take for the EPFO to process and disburse the funds after submitting the online application?

The processing time for online PF withdrawal applications can vary depending on the workload of the EPFO and the complexity of the application. Typically, it takes between 15 to 30 days for the funds to be disbursed to your bank account.

4. What documents do I need to upload while submitting the online application?

The required documents may vary depending on the specific circumstances of your withdrawal. However, common documents include your resignation letter, bank statement, and KYC documents.

5. What happens if my application is rejected?

If your application is rejected, you will receive a notification from the EPFO explaining the reason for rejection. You can then address the issues and resubmit the application with the necessary corrections.

Tips for Online PF Withdrawal

-

Maintain Accurate Records: Keep all your employment documents, bank statements, and other relevant information readily available.

-

Contact Your Employer: Inform your employer about your intention to withdraw PF funds and seek their approval.

-

Check Your Bank Account Details: Ensure that your bank account details are up-to-date and accurate in the application form.

-

Verify Application Status Regularly: Monitor the progress of your application online by checking the "Claim Status" section on the Unified Portal.

-

Contact EPFO Support: If you encounter any issues or have questions, contact the EPFO’s customer support for assistance.

Conclusion

The online PF withdrawal process offers a convenient and efficient way for individuals to access their EPF savings after resignation. By understanding the steps involved, ensuring accurate information, and adhering to the EPFO’s guidelines, individuals can navigate the process seamlessly and receive their funds promptly. It is crucial to maintain accurate records, communicate with the employer, and verify the application status regularly to ensure a smooth and timely withdrawal experience. The EPFO’s online portal provides a valuable resource for individuals seeking to access their hard-earned savings, enabling them to manage their finances effectively during and after their employment tenure.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the Online PF Withdrawal Process After Resignation: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!