Navigating the Online Withdrawal of Provident Fund After Job Separation: A Comprehensive Guide

Related Articles: Navigating the Online Withdrawal of Provident Fund After Job Separation: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Online Withdrawal of Provident Fund After Job Separation: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Online Withdrawal of Provident Fund After Job Separation: A Comprehensive Guide

The Provident Fund (PF) is a crucial element of financial security for employees in India. It serves as a retirement savings scheme, accumulating contributions from both the employee and employer throughout their employment tenure. When an employee leaves their job, they have the right to withdraw their accumulated PF funds. This guide provides a comprehensive understanding of the online process for withdrawing PF after job separation, covering essential steps, necessary documentation, and frequently asked questions.

Understanding the Withdrawal Process:

The process of withdrawing PF funds online is designed to be user-friendly and accessible to all members. It eliminates the need for physical visits to PF offices, streamlining the process and allowing for swift access to your hard-earned savings.

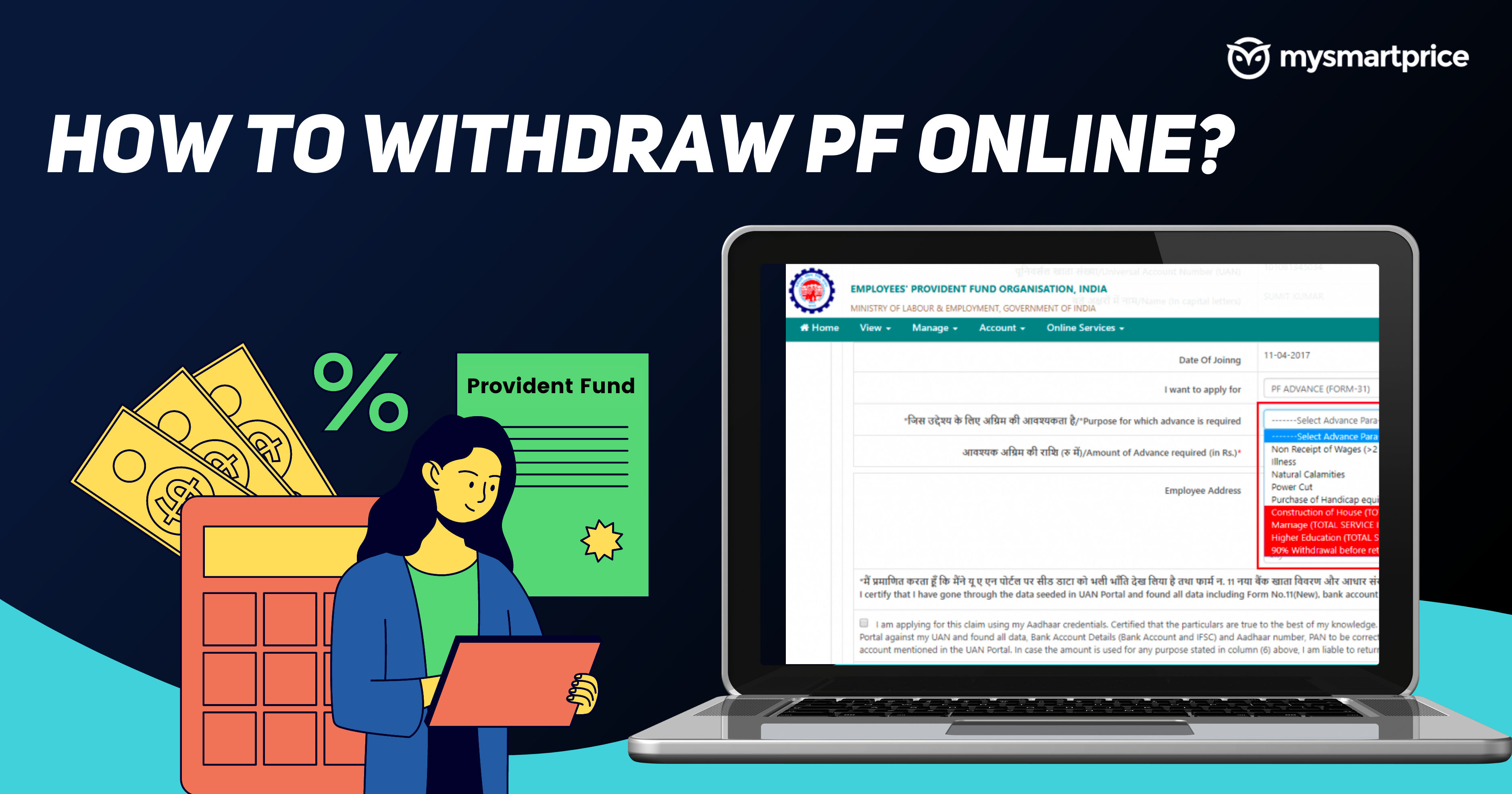

Step-by-Step Guide to Online PF Withdrawal:

-

Register on the EPFO Website:

- Visit the official website of the Employees’ Provident Fund Organisation (EPFO) at https://www.epfindia.gov.in/.

- Locate the "For Employees" section and click on "Member UAN/Online Services."

- Select "Register" and enter your Universal Account Number (UAN), your mobile number, and your Aadhaar number.

- Verify your registration through the One-Time Password (OTP) sent to your registered mobile number.

-

Activate UAN:

- Once registered, activate your UAN by entering your PF account details (PF number and name) from your previous employer.

- The EPFO will verify your details and activate your UAN, enabling access to online services.

-

Submit Online Withdrawal Form (Form 19 or Form 10C):

- Login to your UAN account using your UAN and password.

- Navigate to the "Online Services" section and select "Claim (Form 31, 19 & 10C)."

- Choose the appropriate withdrawal form:

- Form 19: Used for full withdrawal of PF funds after leaving employment.

- Form 10C: Used for partial withdrawal of PF funds for specific purposes like home loan, marriage, or medical expenses.

- Fill out the form accurately, providing details like your bank account information, reason for withdrawal, and the amount you wish to withdraw.

- Upload supporting documents, such as your resignation letter or termination letter, as required.

-

Track the Status of Your Claim:

- After submitting your claim, you can track its progress through the "Track Claim Status" option on the EPFO website.

- The EPFO will process your claim and transfer the funds to your nominated bank account.

Essential Documentation for Online PF Withdrawal:

- UAN: Your Universal Account Number is crucial for accessing online services.

- Aadhaar Card: Your Aadhaar card is necessary for verification and processing of your claim.

- Bank Account Details: Provide your bank account number, IFSC code, and account holder name for the transfer of your funds.

- Proof of Identity and Address: You may be required to upload proof of identity and address documents, such as a PAN card, voter ID, or passport.

- Resignation Letter or Termination Letter: This document is essential for validating your claim for withdrawal.

- Other Supporting Documents: Depending on the reason for withdrawal, you may need additional documents, such as a marriage certificate, medical bills, or loan documents.

Benefits of Online PF Withdrawal:

- Convenience: The online process eliminates the need for physical visits to PF offices, saving time and effort.

- Speed: Online claims are processed faster compared to manual procedures.

- Transparency: The online platform allows you to track the status of your claim and monitor the progress of your withdrawal request.

- Security: The EPFO website uses secure encryption protocols to protect your personal and financial information.

Frequently Asked Questions (FAQs):

1. What if I have forgotten my UAN?

- You can retrieve your UAN through the "UAN Forgot?" option on the EPFO website. You will need to provide your PF account details, mobile number, and Aadhaar number.

2. How long does it take for the PF funds to be credited to my account?

- The processing time for PF withdrawal claims can vary depending on the volume of claims and the verification process. However, it typically takes 2-4 weeks for the funds to be credited to your account.

3. What if my claim is rejected?

- If your claim is rejected, the EPFO will provide you with a reason for the rejection. You can then address the issue and resubmit your claim.

4. Can I withdraw my entire PF balance before the age of 58?

- Yes, you can withdraw your entire PF balance before the age of 58 if you meet certain conditions, such as leaving employment, starting a new job, or becoming unemployed.

5. Is there a minimum amount I can withdraw?

- There is no minimum amount for withdrawal. You can withdraw any amount from your PF account as per your requirements.

Tips for Online PF Withdrawal:

- Keep your UAN and password safe and secure.

- Ensure that your mobile number and email address are updated with the EPFO.

- Double-check all the information you enter in the online forms.

- Upload all the required documents in the correct format and size.

- Track the status of your claim regularly.

- Contact the EPFO helpline or your previous employer if you have any questions or encounter any difficulties.

Conclusion:

Withdrawing your PF funds online after leaving your job is a straightforward process when you understand the steps involved. By following the guidelines and taking advantage of the online platform, you can access your hard-earned savings efficiently and securely. The online system offers convenience, speed, transparency, and security, making it the preferred method for withdrawing your PF funds. Remember to keep your UAN and password safe, ensure your contact information is up-to-date, and maintain accurate documentation for a smooth withdrawal experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Online Withdrawal of Provident Fund After Job Separation: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!