Navigating the Path to Success: A Comprehensive Guide to H&R Block Career Opportunities

Related Articles: Navigating the Path to Success: A Comprehensive Guide to H&R Block Career Opportunities

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Path to Success: A Comprehensive Guide to H&R Block Career Opportunities. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Success: A Comprehensive Guide to H&R Block Career Opportunities

H&R Block, a renowned leader in the tax preparation industry, offers a diverse range of career opportunities for individuals seeking professional growth and fulfillment. Beyond its well-established reputation, the company provides a supportive environment that fosters development and empowers employees to make a meaningful impact. This comprehensive guide delves into the various career paths available at H&R Block, highlighting the company’s commitment to employee well-being, professional development, and its dedication to providing exceptional customer service.

A Tapestry of Opportunities:

H&R Block’s commitment to offering a rewarding career experience is evident in its diverse range of career opportunities across various departments. From customer-facing roles to behind-the-scenes operations, individuals with a variety of skills and backgrounds can find a fulfilling niche at H&R Block.

1. Tax Professionals:

The cornerstone of H&R Block’s success lies in its dedicated team of tax professionals. These individuals are at the forefront of customer interaction, offering expert advice and guidance to help clients navigate the complexities of tax preparation.

- Tax Preparers: This entry-level role provides a solid foundation in tax preparation, allowing individuals to gain practical experience and build their knowledge base.

- Enrolled Agents (EAs): EAs possess specialized knowledge and expertise in tax law, enabling them to represent clients before the Internal Revenue Service (IRS).

- Certified Public Accountants (CPAs): CPAs bring a comprehensive understanding of accounting principles and tax regulations to the table, offering advanced financial and tax advisory services.

2. Operations and Technology:

Behind the scenes, a dedicated team ensures the smooth functioning of H&R Block’s operations and technological infrastructure.

- IT Professionals: These individuals play a vital role in maintaining and developing the company’s technology systems, ensuring optimal performance and security.

- Operations Specialists: These professionals oversee the day-to-day operations of H&R Block offices, ensuring efficiency and compliance with company policies.

- Data Analysts: Data analysts leverage their expertise to analyze trends, identify patterns, and provide valuable insights that inform business decisions.

3. Marketing and Sales:

H&R Block’s marketing and sales teams are responsible for promoting the company’s services and attracting new clients.

- Marketing Specialists: These professionals develop and implement marketing strategies, leveraging various channels to reach target audiences.

- Sales Representatives: Sales representatives connect with potential clients, understanding their needs and offering tailored solutions to meet their tax preparation requirements.

4. Human Resources and Finance:

The human resources and finance departments play crucial roles in supporting H&R Block’s overall success.

- HR Professionals: HR professionals are responsible for recruitment, employee relations, training, and development, ensuring a positive and productive work environment.

- Finance Professionals: Finance professionals oversee the company’s financial operations, ensuring accurate accounting, budgeting, and financial reporting.

Cultivating a Culture of Growth:

H&R Block recognizes the importance of investing in its employees, offering a comprehensive range of benefits and development opportunities to support their professional growth.

1. Comprehensive Benefits Package:

H&R Block provides a robust benefits package that caters to the diverse needs of its employees, including:

- Health Insurance: Comprehensive health insurance plans, including medical, dental, and vision coverage.

- Retirement Plan: A 401(k) plan with a company match, allowing employees to save for their future.

- Paid Time Off: Generous vacation and sick leave policies to ensure employees have adequate time for rest and rejuvenation.

- Employee Assistance Program: Access to confidential counseling and support services to address personal and professional challenges.

2. Professional Development Opportunities:

H&R Block is committed to fostering a culture of learning and development, offering a wide array of resources to support employee growth:

- Training Programs: Comprehensive training programs covering various aspects of tax preparation, customer service, and professional development.

- Mentorship Programs: Mentorship programs connect experienced employees with newer team members, providing guidance and support.

- Tuition Reimbursement: Financial assistance for employees pursuing higher education, encouraging continuous learning and skill development.

- Career Advancement Opportunities: Clear career paths and opportunities for promotion, enabling employees to advance within the company.

3. A Culture of Inclusion and Diversity:

H&R Block is dedicated to creating a diverse and inclusive work environment where everyone feels valued and respected. The company actively promotes equal opportunities for all employees, regardless of their background, ethnicity, gender, or sexual orientation.

Navigating the Application Process:

For individuals seeking to embark on a career journey with H&R Block, the application process is straightforward and user-friendly.

1. Explore Career Opportunities:

Start by visiting the H&R Block Careers website, where you can browse open positions across various departments and locations.

2. Submit Your Application:

Once you identify a suitable role, carefully review the job description and submit your application online. Be sure to tailor your resume and cover letter to highlight your relevant skills and experiences.

3. Interview Process:

If your application is selected, you will be invited for an interview. The interview process may involve multiple stages, including phone screens, in-person interviews, and possibly skills assessments.

4. Offer and Onboarding:

Upon successful completion of the interview process, you will receive an offer of employment. Once you accept the offer, you will be guided through the onboarding process, which includes paperwork, training, and introductions to your new team.

Frequently Asked Questions (FAQs):

1. What are the qualifications required for a tax preparer position at H&R Block?

Typically, a high school diploma or equivalent is required. However, some positions may require a college degree or relevant experience in tax preparation.

2. Does H&R Block offer any training programs for new employees?

Yes, H&R Block provides comprehensive training programs for all new employees, covering tax preparation techniques, customer service skills, and company policies.

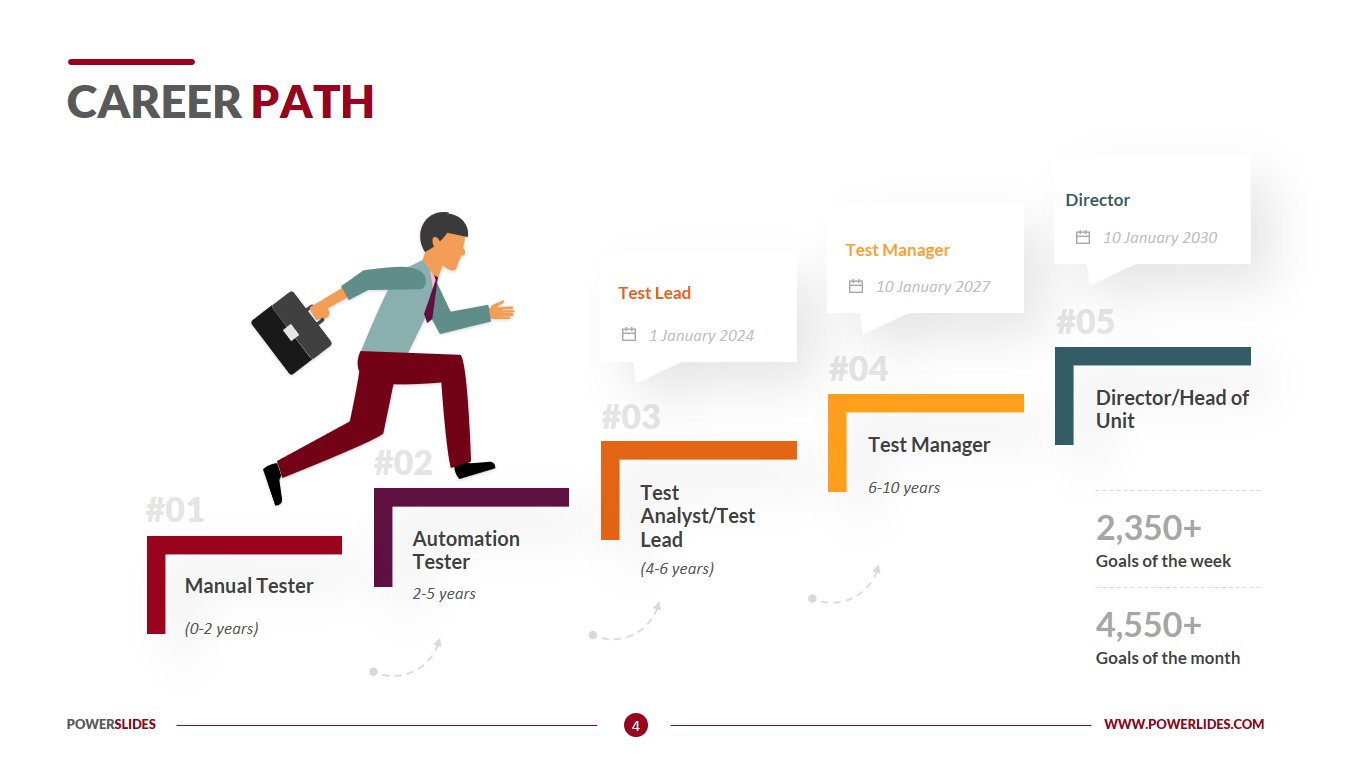

3. What are the career advancement opportunities at H&R Block?

H&R Block offers clear career paths for its employees, with opportunities for promotion to roles such as Senior Tax Preparer, Tax Manager, or Regional Manager.

4. Is there a specific time of year when H&R Block hires the most employees?

H&R Block typically hires a significant number of employees during the tax season, which runs from January to April. However, the company also hires throughout the year for various roles.

5. What is the work environment like at H&R Block?

H&R Block fosters a collaborative and supportive work environment, where employees are encouraged to learn from each other and contribute to the company’s success.

Tips for Success:

1. Showcase your Tax Knowledge: Highlight your understanding of tax laws, regulations, and preparation techniques.

2. Emphasize Customer Service Skills: Demonstrate your ability to communicate effectively, build rapport, and provide exceptional customer service.

3. Demonstrate Strong Work Ethic: Emphasize your commitment to hard work, dedication, and a willingness to go the extra mile.

4. Stay Updated on Tax Changes: Keep abreast of the latest tax laws, regulations, and industry trends.

5. Network with Tax Professionals: Attend industry events, connect with tax professionals on LinkedIn, and build your professional network.

Conclusion:

H&R Block offers a compelling career path for individuals seeking professional growth and fulfillment. The company’s commitment to employee well-being, professional development, and its dedication to providing exceptional customer service make it an attractive employer for those seeking a rewarding and enriching work experience. By embracing the opportunities available and pursuing continuous learning, individuals can thrive within H&R Block’s dynamic and supportive environment, contributing to the company’s success while building a fulfilling and rewarding career.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Success: A Comprehensive Guide to H&R Block Career Opportunities. We hope you find this article informative and beneficial. See you in our next article!